Progress for 0 ad

Progress for 1 ad

Progress for 2 ad

Progress for 3 ad

Munir Shemsu

Addis Ababa, Ethiopia

EthSwitch's role goes beyond ATM interoperability. The national switch operator plays a crucial role in building trust, reducing costs, and fostering financial inclusion throughout Ethiopia.

This article is part of AKOFADA, a project that is working to increase knowledge and transparency within Ethiopia’s DFS ecosystem.

___

Dozens of people are queued up around four Automated Teller Machines (ATMs) near the Haya Hulet area in the Ethiopian capital on a Friday. A few blocks down, another line has formed with just as many urbanites trying to get cash on hand before the weekend. Yet, a cursory look at the queues reveals an eerie pattern. Some of the ATMs are flickering idle with the majority of the crowd lined up in front of a few machines.

Samuel Tafesse, 39, was among the group waiting in line behind a Commercial Bank of Ethiopia ATM despite an open ATM from Dashen Bank being available right next to him. The middle school teacher avoids the ‘risk’ of having his money withheld by the machine and having to call two banks to resolve the mishap.

“I had to wait nearly a month for 2,000 birr a year back,” Samuel recalls.

He also feels that the transaction charges arising from the transfer of funds between banks cut too deeply into the relatively small sums he withdraws. Interestingly, 50 cents is charged to customers out of every 100-birr withdrawn from an ATM accessing the interbank infrastructure with barely any difference, even if it is from the same bank.

But not everyone sticking to an ATM of their respective bank resorts to a previous bad experience to explain their behavior. Surprisingly enough, some report being unaware of the ability to withdraw money from a different bank’s ATM. Most, however, express a desire to avoid additional fees, while a few fear that the odds of their money being withheld increase with the use of another bank’s machine. Perhaps most striking about this fear is its lack of a realistic foundation, as nearly 94% of ATM transactions were successful over the past financial year.

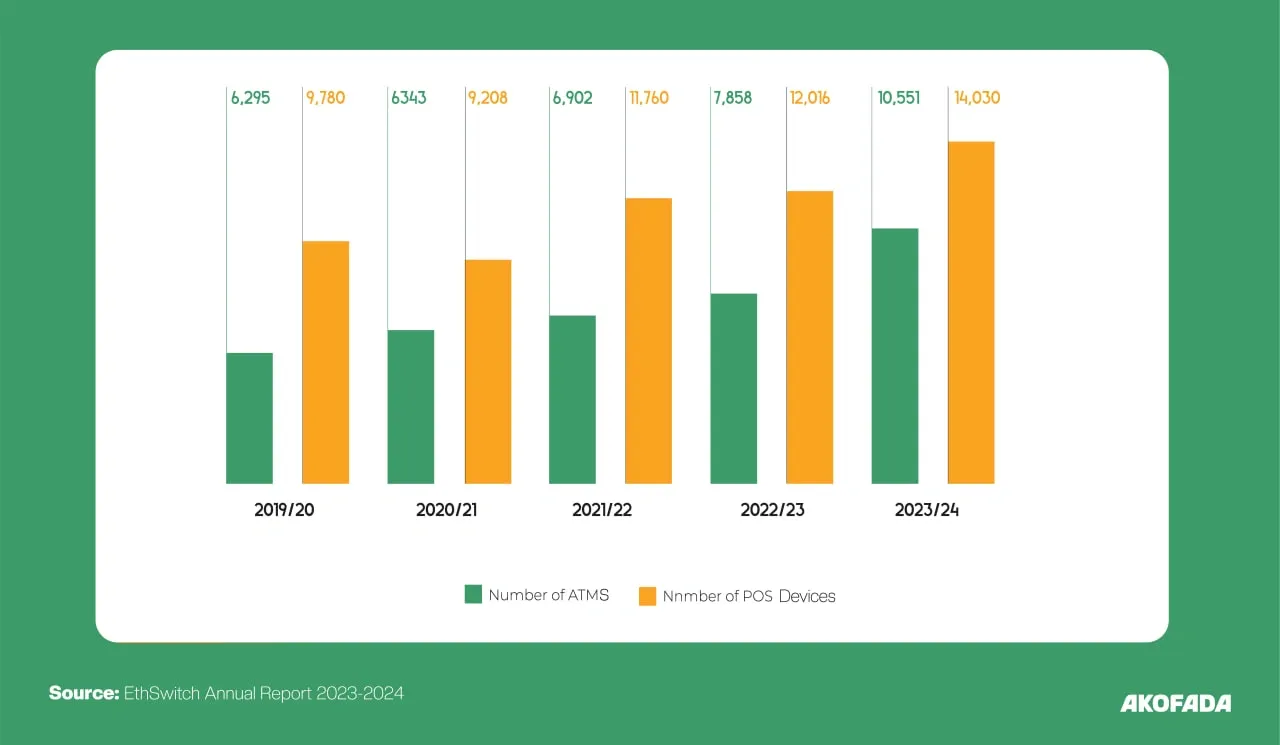

While it may be surprising to learn that urbanites living in the capital still harbor reservations about the interoperability of ATMs, it’s alarming to think of the implications for financial inclusivity such anxieties might have in rural and semi-urban areas. It is quite unlikely that someone earning less than two dollars a day in rural Ethiopia will begin her formal financial journey relying on ‘unreliable’ technology. Unfortunately, there are less than 11,000 ATMs across the country, rendering even access to machines very unlikely for most.

With the expansive adoption of digital financial services (DFS) increasingly becoming a preferred policy intervention to fast-track financial inclusion, fostering confidence in the enabling substructure is crucial to meeting the target.

Perceived ease of use, a value proposition superior to cash, perceived cost, and trust remain key determinants to driving DFS adoption alongside expanding connectivity, developing quality systems, and rolling out affordable technology. Both the technical capacity and the public perception of the seamlessness of the underlying infrastructure are powerful forces in driving adoption.

While several stakeholders contribute to building the overall enabling infrastructure, switch operators provide one of the most vital functions in the digital financial ecosystem. Through transmission, reconciliation, confirmation, and netting of transactions and settlement processing fund transfers, reconciliation between accounts, and facilitating settlements between banks—they constitute a foundational pillar on which a digital financial ecosystem can thrive. Most switch operators also provide fraud monitoring, dispute management, and anti-money laundering services, which help maintain the integrity of the payment ecosystem.

Ethiopia currently hosts two switch operators: the national EthSwitch S.C. and the more localized Premier Switch S.C. Both have financial institutions as shareholders, while EthSwitch also has the National Bank of Ethiopia (NBE) in its ownership structure.

EthSwitch’s board is chaired by the vice governor of the NBE in line with the Company’s critical role in the government’s national digital payments strategy. The three-year strategy places the creation of an interoperable e-payment platform infrastructure for Ethiopia as the primary strategic pillar in nurturing financial inclusivity. EthSwitch is one of the key players in NBE’s plan to attain a 70% financial inclusion rate by 2025 through accelerating the development of an inclusive payment infrastructure.

As the Company marks eleven years since its establishment, marked by increasing annual profits, it still has a long way to go before realizing an inclusive instant payment system. The 2024 AfricaNenda report on inclusive instant payment systems in Africa indicates that EthSwitch's total volume of transactions amounted to 3% of the country’s Gross National Income (GNI). The Company is still perceived by prospective customers as an enabler of ATM transactions and little more.

A closer look at the history, current capacity, and prospects of the national switch operator yields insights into untapped opportunities and prevailing constraints for driving DFS adoption in Ethiopia.

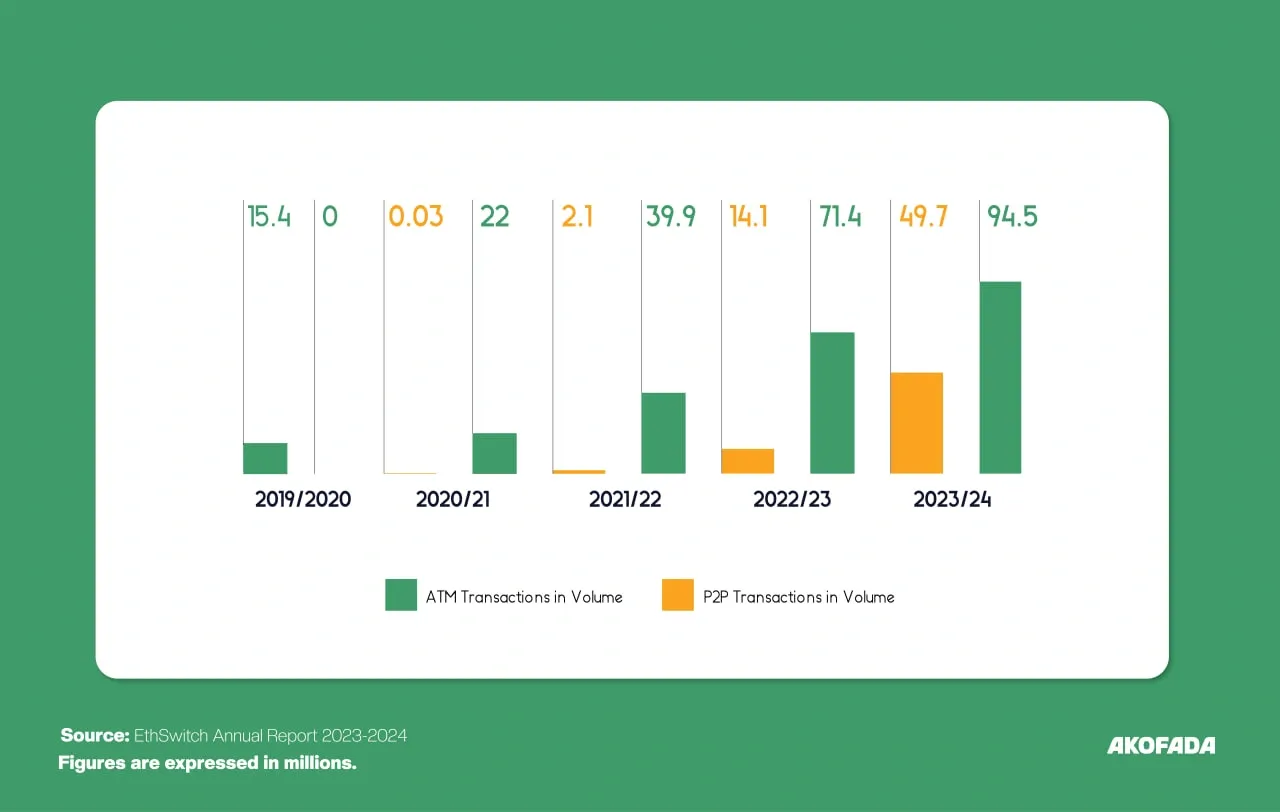

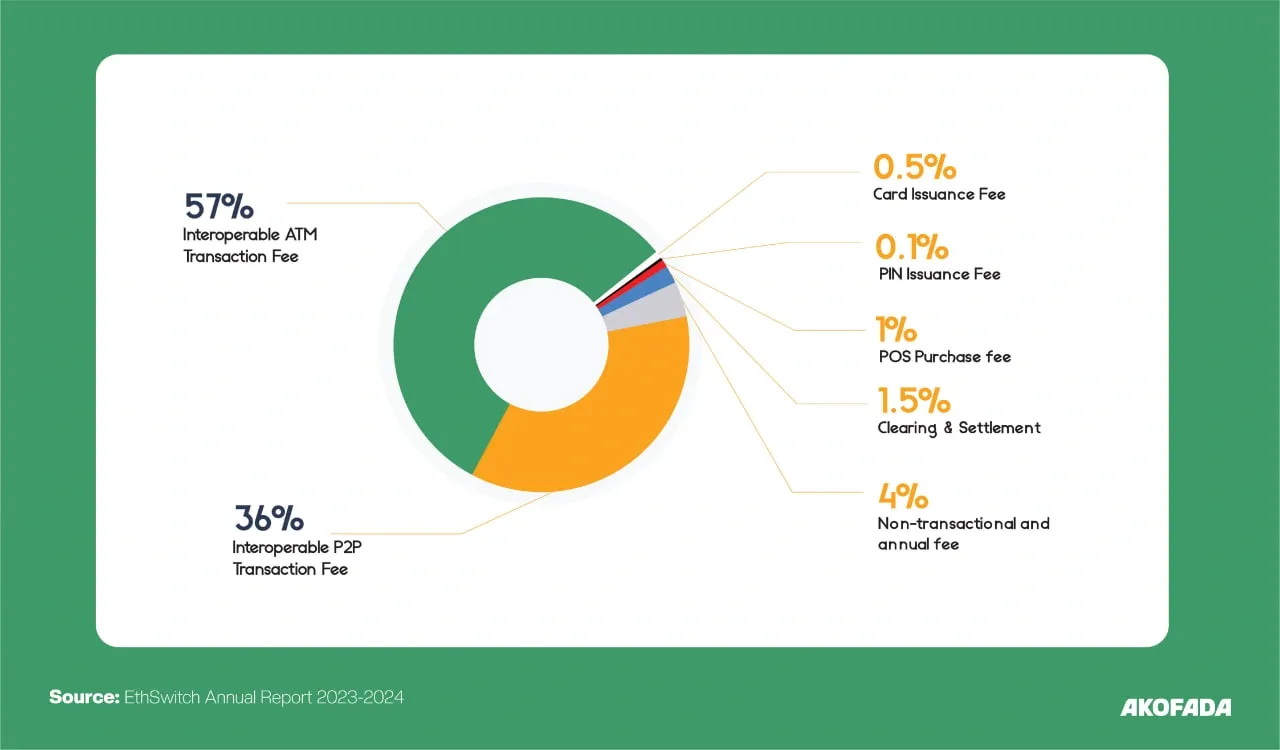

EthSwitch’s interoperability of ATMs, which has advanced rapidly over the past few years, often comes to the forefront when assessing the capacities of the national switch operator. While ATM interoperability still accounts for nearly 57% of the Company’s revenue, it has evolved its capabilities in a host of services.

Throughout its eight years of operations, the Company has enabled a gradual increase in person-to-person services (P2P), with the amount even taking over ATM interoperability in 2023/34. A remarkable feat considering that one of the biggest mobile money operators in the country, telebirr, is not included.

The national switch operator facilitated 123.2 billion worth of interoperable ATM transactions during the year while P2P transfers grew by 251% to reach 270 billion birr. P2P services facilitated by EthSwitch went through 29 banks, 6 microfinance institutions, a pair of payment instrument issuers, and one digital wallet provider. Significant growth also occurred in the interoperability of Point-of-Sale (PoS) transactions, which grew by 91% to reach 5.66 billion birr over the year. PoS transactions have grown nearly ten-fold in volume over the past five years, reaching a little over 10 million in 2023/24. While seven different services account for EthSwitch’s revenue, ATM interoperability and P2P services remain most impactful to most Ethiopians.

However, responsive redress mechanisms, clear limits on transferable amounts, real-time settlement through multiple options, and expansion of enabling financial and technology infrastructure in rural and semi-urban areas endure critical handicaps. Nearly 47% of ATMs and 77% of POS machines were estimated to be in Addis Ababa, the capital of Ethiopia, and in proximity to bank branches, according to NBE.

EthSwitch’s management is aware of the formidable path ahead as the Company navigates its crucial role in accelerating DFS adoption and financial inclusion.

Yilebes Addis, CEO of EthSwitch, says the creation of a simple and affordable payment ecosystem remains one of the Company’s enduring and foundational goals. He emphasized the need to build a shared infrastructure to enable the reduction of costs for each financial service provider.

“Reduction of costs incurred by each institution brings down fees levied on customers,” the CEO underscored.

The ownership structure and distribution of expenses are reflective of a trend across Africa where 11 national switch operations are managed through public-private partnerships.

Yilebes referred to the absence of fees on customers in the recently piloted National Payment Gateway and the three-year-old POS infrastructure to signal affordable rates in upcoming services. Acknowledging the shortage of both ATMs and POS machines beyond the capital, major cities, and a few high-end stores and hotels, the CEO indicates the need to create tailored solutions in order to foster DFS adoption.

He pointed to the rollout of standardized interoperable QR codes in recent months as an instance of a simple and low-cost option that can spur DFS adoption.

“Convenience is just as important as price,” the CEO says.

Geographical reach remains limited, as there are just 10,551 ATMs and around 14,000 POS terminals active in a country of above 120 million and where nearly 250,000 new business permits are given out annually. Most transactions are concentrated in Addis Ababa, the capital, and a few regional cities.

EthSwitch’s management recognizes the importance of expanding use cases for payment services accessible through feature phones to foster DFS adoption. The National Switch obtained grants to enable near-free accessibility of the infrastructure as well as to maintain recovery of costs for the next five years. The Company launched its Real-time Retail Payments Platform Project in Ethiopia in 2022 after receiving funding to modernize the country’s retail payment system from the African Development Bank’s Africa Digital Financial Inclusion Facility and the Bill & Melinda Gates Foundation.

Still, EthSwitch has sourced significant revenue from the POS service by charging the financial institutions instead of customers. The 2023/24 annual report of EthSwitch shows that the company obtained nearly 1.45 billion birr in overall revenue, which grew by 89% from the previous year.

Ensuring easy accessibility of a shared infrastructure is a crucial element in bringing down transaction costs for operators and users alike. Competition naturally creates tension with big and small players accessing the same tools, necessitating a delicate balance in pricing and fees.

EthSwitch’s variable rates in ATMs entail progressively declining piece rates the more ATMs an individual bank has. A similar model of decreasing rates per increasing machines applies to the POS charges as well. The more POS or ATMs the hosted banks have, the lower the rate per machine will be.

As the Company works on the enablement of an inclusive instant payment system, its management has identified the importance of simplifying redress mechanisms. A joint task force has been established to develop the response capacity of financial service providers. However, the responsibility of constantly tweaking operations to improve customer experience rests on financial institutions that have direct access to customers. EthSwitch annually awards financial institutions based on the success rate of their ATM, POS, and P2P transactions.

As Ethiopia’s financial industry braces for a major shakeup with the imminent entry of foreign banks, EthSwitch has prepared itself to accommodate them with services on par with those afforded to their local counterparts. The Company is also entrusted with facilitating the recent currency swap deal between the UAE and Ethiopia by interlinking with its Gulf counterpart.

EthSwitch is increasingly being assigned major responsibilities by the central bank to realize financial inclusivity targets. The Company has initiated pilot Instant Payment System transactions as part of improving clearing and settlements in the past year. A shared wallet project also moved into testing and integration as part of a digital financial inclusivity initiative.

Industry insiders often laud the aspirations of the national switch operator towards realizing an inclusive payment ecosystem despite voicing concerns about prevailing external and internal constraints. Low phone ownership across the country, lack of internet access, absence of use cases for Ethiopia’s rural populace, financial gender divides, and the limited scalability of EthSwitch’s current services are a few barriers. Ethiopia’s rural population accounts for nearly 80% of the country’s demography, intimately weaving financial inclusivity targets with moving beyond ATM interoperability.

While some of the challenges remain out of the Company’s capabilities, it is well-placed to address crucial setbacks limiting the adoption of digital financial services.

While EthSwitch has played a pivotal role in accelerating the rapid expansion of interoperability between financial institutions in Ethiopia, it has largely remained a passive recipient of innovation from others. In terms of inclusivity, the national switch is categorized as a cross-domain IPS and is among the 12 basic such systems across Africa. Iterative innovations to accelerate the rapid dissemination of use cases, tools, and interoperable capacities have shown themselves to be highly consequential in compounding the powers of switches for driving DFS adoption.

Some switches across Africa have managed to leverage their position to also serve as a center of innovation and an example of transparency in the financial sector.

The Ghana Interbank Payment Settlement System (GhIPPS), a wholly owned subsidiary of the country’s central bank, is the only switch operator across the continent enabling all-to-all interoperability with multiple systems aggregated into a cross-domain ecosystem for end users. After beginning operations via a biometrically enabled e-zwich card to enable interbank services in 2008, GhIPPS followed with an automated clearing and settlement system three years later that laid the groundwork for the real-time payment service called GhIPSS Instant Pay (GIP) by 2015. In what has been dubbed the financial inclusion triangle, the Ghanaian national switch employed a three-tier system that facilitated interoperability between mobile money, bank accounts, and stored value cards.

Innovative use case introductions like inventory and business services, tax payments, salaries, and even social disbursements have allowed GhIPPS to spur the adoption of DFS services nationally. Buttressed by evolving financial legislations in Ghana, scheme rules that included a 24/7 uptime, a 40-second response time by receiving institutions, and recourse mechanism guidelines have combined to provide convenience to customers. Two years back, GhIPPS managed to introduce an open application available through both smart and yam phones that facilitate financial services without the need for a bank account.

The carefully calibrated strategies that have allowed Ghana to have an adult financial inclusion rate of nearly 96% indicate easily adoptable strategies for other countries. Constant collaborations with financial institutions, allowance of low-value transactions, a predictable framework of operations, transparent and frequent reports, and perhaps most importantly, continuous innovation are worthwhile lessons from the Ghanaian switch.

As the Ethiopian central bank looks to attain 6 billion annual transactions through digital payment options by 2026, a tailored evolution of the national capacities could prove highly consequential. There is also a need to put in place a series of comprehensive awareness creation campaigns to overcome mostly unsubstantiated apprehensions about using IPS functionalities.

Close collaborations between the financial institutions and the switch operator can serve as a fertile ground to spark ideas and innovation. Bridging the infrastructure, awareness, geographical, and capital barriers derailing Ethiopia’s financial inclusion goals will require at least a few homegrown solutions. Acceleration of linkages with financial service providers of more agile and purely digital channels like mobile wallets and gateways will likely yield the highest gains in driving DFS adoption.

👏

😂

❤️

😲

😠

Munir Shemsu

Munir S. Mohammed is a journalist, writer, and researcher based in Ethiopia. He has a background in Economics and his interest's span technology, education, finance, and capital markets. Munir is currently the Editor-in-Chief at Shega Media and a contributor to the Shega Insights team.

Your Email Address Will Not Be Published. Required Fields Are Marked *