Progress for 0 ad

Progress for 1 ad

Progress for 2 ad

Progress for 3 ad

Progress for 4 ad

Progress for 5 ad

Etenat Awol

Addis Ababa, Ethiopia

Less than a year since its launch, Yango, an international ride-hailing service by Russian tech giant Yandex, has quickly made its mark on Ethiopia’s transport ecosystem.

With competitive pricing that sets it apart from other operators, Yango’s marketing has proven irresistible for many passengers.

In a sector where new platforms often struggle to survive, Yango’s rapid growth in user numbers mirrors the early success of Feres. Yango has achieved 1 million downloads within just ten months.

Yekenalem Abebe (PhD), Country Manager of Yango, attributes the company’s swift success to its robust offline and online marketing campaign. He referred to the company’s partnerships with nearly 70 TikTok influencers on top of a brand ambassador to highlight the targeting of a tech-savvy younger demographic.

“Increased brand visibility and strong connections with potential users have been the result,” Yekenalem told Shega.

While close to 42 companies are registered to provide app-based taxi services in the capital, around a dozen are operational, and two institutions (Feres and Ride) have been dominating the market before.

A distinctive pricing and marketing strategy is becoming increasingly pivotal in acquiring market share in the industry nearing a decade in Ethiopia.

Yango’s competitive pricing, with a flag-down fee of 72 birr—nearly 30% lower than other providers—is also one of the key factors attracting users. With a monthly growth of 600% in the number of users and a nearly 40% increase in registered drivers, Yango is carving out its own slice of the market.

This pricing strategy, which includes a 50% discount on the first three trips, has stirred significant interest from customers. Additionally, Yango’s 7% commission on driver earnings is lower than the industry standard.

Launched in 2018, Yango employs its own mapping and routing systems to locate and transport passengers. Globally, the platform operates in 12 other African countries and has around 600,000 registered drivers. The Russian-based service, which is valued at over 1.5 billion dollars, leverages this international experience to compete in Ethiopia.

Yango entered the nation through a franchise agreement with G2G IT Group, designating the Group to manage service operations in the country.

The platform does not have country-specific apps, and the ride-hailing app has been downloaded over 10 million times on the Play Store. This means a significant amount of Yango’s global user base, comes from Ethiopia, further indicating the importance of the nation in the app’s global presence.

Yango’s broad targeting of customers is different from the driver-centric strategies employed by newcomers like Adika and Safe. By initially focusing on drivers, these new ride-hailing companies are generating revenue in this highly competitive market, which can later be used to attract riders.

However, Yango’s emphasis on capitalizing on its low flag-down fee has also created a negative impression among some drivers.

Fistum Weldegebriel, 42, has no plans to switch to Yango from the older Feres and Ride companies, due to the low flag-down fares. After two years of working as a driver, he questions the financial feasibility of registering with the 10-month-old company.

“It is not worth the sweat,” Fitsum told Shega.

He also believes that orders for rides from the company come from distant neighborhoods, making it both inconvenient and too costly with the small flag-down fare.

Nonetheless, the apprehension of some drivers in registering with Yango has not held back the company from a six-fold increase in user base.

The country manager maintains that the company’s objectives are tethered to maintaining customer affordability and driver profitability.

“We don’t actually take away from the drivers,” Yekenalem says.

He explained how an incentive structure embedded into the system allows drivers to gain an additional 100-150 birr per trip, despite it appearing unlucrative at first glance.

“We are using this as one of our marketing strategies to break into the market,” the country manager noted.

Yekenalem says drivers become eligible for this cashback after completing five trips and attributes the seeming distant pickup locations to the mismatch between registered drivers and the larger number of orders. He suggested that there has been an improvement by referring to the drop in average waiting times to five minutes.

“It is clear that there is nothing wrong with our mapping system,” Yekenalem emphasized.

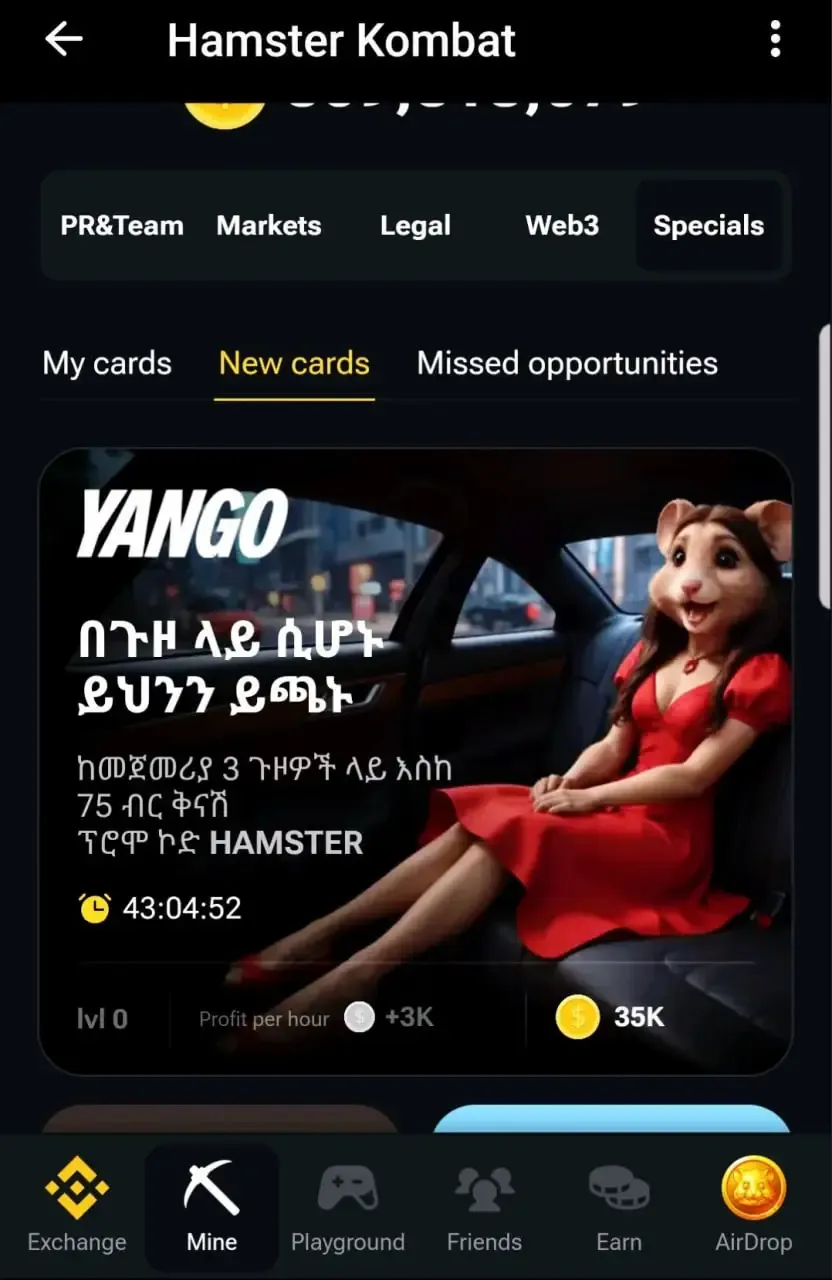

Indicative of Yango’s peculiar marketing strategy, the company has also partnered with Hamster Kombat, a popular gaming platform that allows players to earn coins by currency mining. A promo code weaved into the gaming platform has created further incentives for downloading and using Yango’s services.

“The young tech-savvy demographic aligns perfectly with our target audience,” the country manager underscored.

The country head plans to import features available in the rest of the world, including e-bikes, e-scooters, and delivery services, while also broadening their market to a younger demographic. He foresees official announcements following the formation of a concrete plan and strategy.

Yango’s management is also considering on-boarding vehicles with Code-2 license plates—privately registered automobiles—to offer ride services along their regular commute routes. However, the use of vehicles with Code-2 plates for ride-hailing is currently prohibited.

Another ride-hailing company, Zayride, has been strongly advocating for this change. For the past two years, Zayride, along with the now-defunct Wez, has lobbied authorities to relax industry restrictions by permitting the recruitment of drivers with private license plates.

This ban may soon be overturned, as Prime Minister Abiy Ahmed (PhD) recently suggested to Parliament that private vehicles should be allowed to carry passengers during rush hours.

According to Yekenalem, Yango’s implementation of an incident reporting system, along with legal support upon request, is also providing the company with a competitive edge.

Safety has become a major concern for Ethiopian customers, especially after recent high-profile incidents involving female passengers. Two months ago, local artist Egitu made headlines with social media posts detailing her experience of sexual assault by a driver from Feres.

As attacks on both passengers and drivers increase, concerns over safety have become more pertinent than ever, granting companies that employ strict protocols a strong foothold in the market.

Yango’s swift rise in the Ethiopian market reflects a shift in the ride-hailing landscape. As the company continues to grow, its ability to address driver concerns while maintaining its competitive pricing will be crucial for its long-term sustainability in the nation and serve as a valuable lesson for other emerging ride-hailing companies.