Progress for 0 ad

Team Shega

Addis Ababa, Ethiopia

YaYa Wallet, an upcoming Ethiopian digital wallet payment service provider for mobile peer-to-peer (P2P), person-to-business (P2B), and business-to-business (B2B) payment is offering shares for the public as it finalizes raising 75 Million ETB to join the burgeoning Ethiopian Fintech sector.

Registered as a share company in Ethiopia, YaYa already sold 40 ML ETB ( in cash and in-kind ) in a private placement round. The company made available 75,000 ordinary registered shares with an offer price of ETB 1000 for each share and a minimum investment of 500K ETB. The remaining 30 million amount is currently being sold on a first come first serve basis.

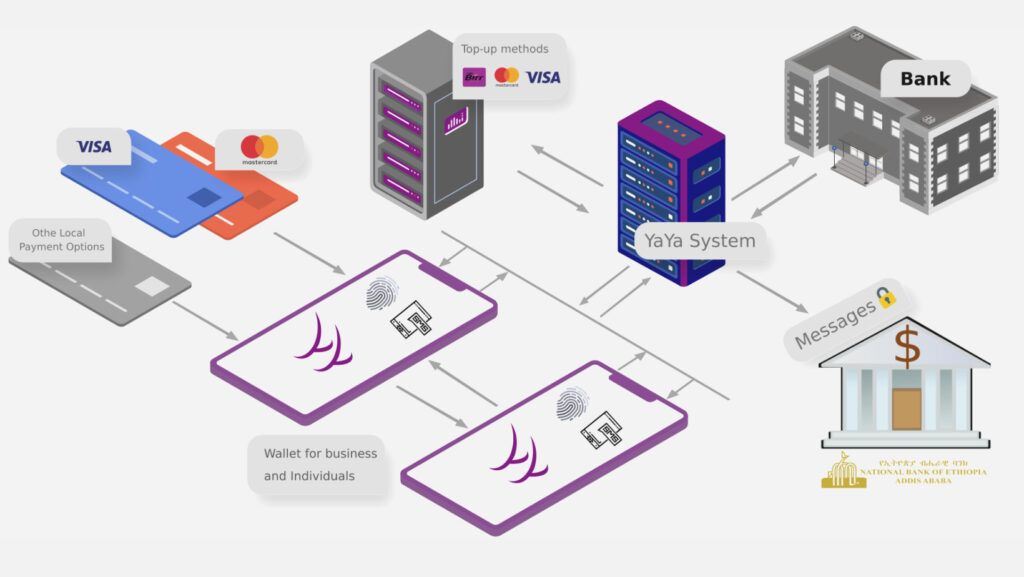

The digital wallet facilitates all sorts of local payments and inward remittances. It will be accessible to anyone having a smartphone and mobile number.

YaYa is founded by Anteneh Gebeyaw, General Manager, and Workineh Kassa, Vice General Manager, who both have decades of experience in Technology and Finance.

Anteneh Gebeyaw, based in Italy, is a graduate of Computer Science, and Computer Engineering. He has built various SaaS products in the eCommerce, digital automotive, and IoT sectors. Anteneh has recently worked on integrating many financing and loan system providers with car dealership platforms.

Workineh Kassa, based in the US, also has more than 14 years of experience in finance. He worked in leading companies across Ethiopia and the US.

Some of the organizers of the Share company include Professor Enyew Adgo, Engineer Abebe Yimenu, and Seyoum Bemelaku.

The digital payment industry is booming worldwide. Data shows that the global digital payments industry is expected to hit $6.6 trillion in value in 2021 up from $5.4trn value in 2020. Even though the sector was steadily growing for the last decade, the pandemic has only accelerated it.

This growth is even expected to continue as technology companies that provide financial services increase their foothold against traditional financial institutions. The digital payments market is expected to reach $10.5trn in value by 2025.

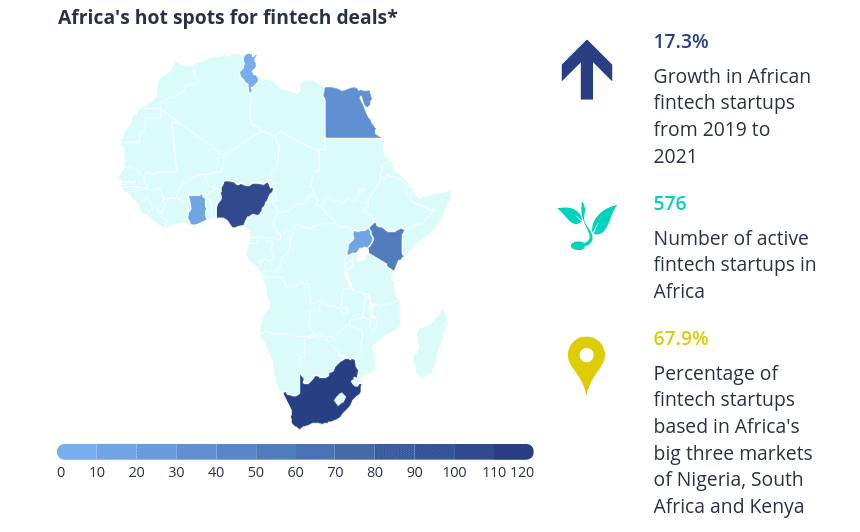

The trend in Africa is no different. Fintech startups across Africa are launching in every corner and raising a significant amount of funding as they try to leapfrog the continent’s undeveloped financial sector.

The number of fintech startups that are active in Africa has increased by 89.4 percent between 2017 and 2021.

According to Statista, From 2015 to 2021, African fintech startups secured nearly 900 million U.S. dollars in investment. Over 53 percent of this amount went to Nigeria, while companies in South Africa received some 25 percent. Kenyan startups secured approximately 10 percent of the total funding

Some of the notable investments this year include Nigerian mobile payment company Opay recent $400M funding round led by SoftBank Vision, cross-border payment startup Chipper Cash $100M Series C, African payment technology company Flutterwave $170M Series C, Nigerian Kuda, and South African TymeBank Digital banking startups who raised $55M and $109M respectively.

African Hot spots For Fintech Deals Source – PitchBook

African Hot spots For Fintech Deals Source – PitchBook

The reality in Ethiopia is even more bullish. After decades of regulatory constraints and a lack of proper attention, the sector is now getting momentum. With the change of regulation that is introduced by the National Bank which effectively allowed non-traditional financial technology companies to engage in payment issuing and processing business, a significant amount of investment is pouring into the fintech sector to serve the millions of unbanked and underserved Ethiopians.

In 2021 alone. Ethiopian Fintech companies have raised more than $8.8 Million in 7 deals according to data from Shega Insight.

Dozens of companies have applied to get a payment instrument issuing and payment system operator license from the National Bank of Ethiopia and are waiting to start operation.

Ethio Telecom, who got the Mobile Money license in Ethiopia, launched its mobile money service Telebirr and already acquired more than 8 million customers in less than 4 months. Ethio Telecom projects USD 13 billion can be generated from mobile money by 2025.

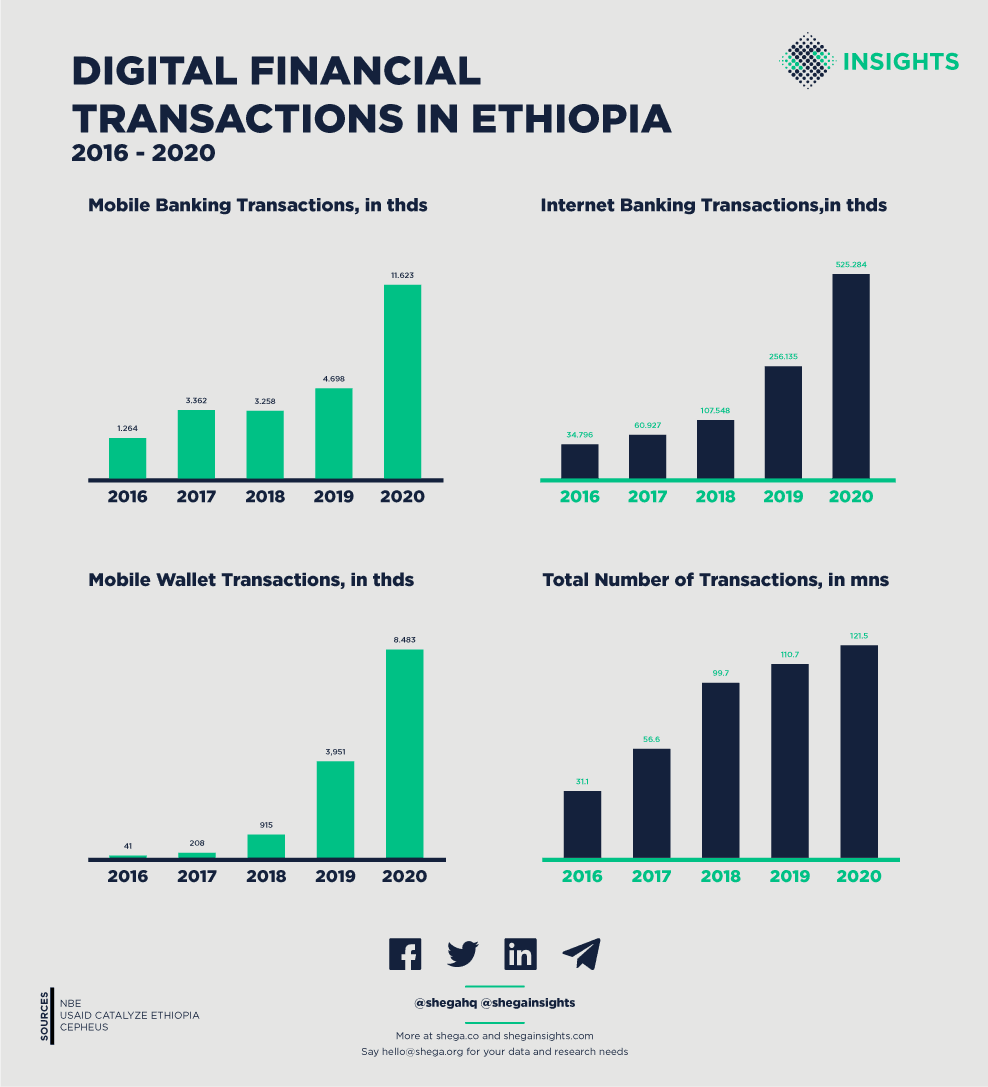

Between 2016 and 2020 the value of transactions transacted through ATM, POS, Mobile Banking, Internet Banking, and Mobile wallet/mobile money channels increase by 415 %, 323 %, 1252 %, 1769 %, and 175939 % respectively according to data from National Bank. Even though the likes of Mobile Money had started from a very low starting base, it’s a clear sign that digital financial services have been picking up significantly.

Digital Financial Transactions in Ethiopia – Shega Insights

Digital Financial Transactions in Ethiopia – Shega Insights

However, despite the growth, it’s still early days. According to Cepheus Research, only ~8% of GDP is being facilitated through Digital channels. In contrast, Kenyans moved nearly half the equivalent of the country’s gross domestic product (GDP) through their mobile phones in 2018.

A report published by Cepheus and USAID CATALYZE Ethiopia: MS4G founds that lack of adoption of digital channels by the wider society, undeveloped merchant payment service, limited product use cases, lack of interoperability with major payment systems, and regulatory restrictions around the fintech ecosystem as a limitation to the growth of digital financial services in Ethiopia.

This is where YaYa comes in. The company aims to address some of these key challenges and take the Fintech space in Ethiopia to its promised destination.

YaYa believes it will address low adoption of online payment by providing a simple product with a sleek design and smooth user experience with scalable infrastructure while delivering a unified solution that works across various customer segments and is integrated with all banks.

Key features of the wallet include QR Codes, multiple accounts in a single wallet, fingerprint authentication, the ability to send/receive payment without needing a phone number, transfer to the group, credit service, recurring payments, bill, and ticket payments, etc.

One of the key reasons for low merchant payment acceptance has been the unavailability of public APIs by payment providers. Integration documentation is already public and available for anyone to access.

Yaya’s Founder and CEO says they follow an API first model. Meaning YaYa products are built on top of the API that is in place first and this approach makes it very easy to integrate YaYa with various services or apps such as other Digital Wallets, CRM, ERP is standardized.

Aiming to address the challenge of interoperability for customers of different Banks, YaYa built its designed system and infrastructure to easily integrate with banks.

The key direction the company is taking is also tapping into the more than 4 billion USD inward Ethiopian remittance market. The platform is designed to operate cross border allowing any Ethiopian diaspora to register with their foreign phone number and transact by topping up using their debit/credit cards, PayPal, and other channels.

YaYa is processing a payment instrument issuer license according to the new regulation by the National bank of Ethiopia. The prospectus submitted to NBE by the company is approved and the regulator is reviewing YaYa’s business plan currently,

Even though the company is launching in Ethiopia, it also targets regional expansion and is looking at different African countries in the first 3 years of launch.

YaYa has finalized its product development. After closing the fundraising and getting the license, it plans to launch immediately.

Interested Individuals or companies can register here to buy shares.

Partner Content

Read Disclosure Page.

👏

😂

❤️

😲

😠

Team Shega

Your Email Address Will Not Be Published. Required Fields Are Marked *