Progress for 0 ad

Kaleab Girma

Addis Ababa, Ethiopia

Officials at the federal government have exempted ride-hailing drivers from paying turnover tax (TOT) and value-added tax (VAT). The decision follows the Minister of Finance and Addis Ababa Revenue Bureau recognizing ride-hailing services as transport service providers, diverging from their previous categorization of these vehicles as rental service providers.

In a letter dated July 5, 2023, the Addis Ababa Revenue Bureau notified its subordinate offices about the latest development, instructing them to exclude VAT and TOT when collecting taxes from ride-hailing drivers.

“According to a brief sent from the Ministry of Finance, although meter taxi vehicles under code 03 plates are registered as rental services, the service they provide is transportation,” reads the letter signed by Taye Masersha, an official at the Bureau.

“Thus… [ride-hailing drivers] are exempt from VAT and TOT,” adds the letter.

In Addis Ababa, many ride-hailing drivers opt to use commercial license plates (code 3) instead of code 1 plates, which are specifically designated for transport service providers. Drivers argue that the code 3 designation grants them greater freedom with their vehicles, such as the ability to maintain the original color of their cars, while code 1 vehicles are required to be painted blue or yellow.

In addition, ride-hailing drivers obtain their business license under the car rental service category, which permits them to provide transport services without being tied to public transport requirements.

While tax issues have been the most recent concern, this particular matter has been the source of numerous conflicts between the city’s officials and the ride-hailing sector.

Starting from issuing a directive that prohibited vehicles with code 03 plates from providing ride-hailing service to ceasing the distribution of Code 3 plate numbers altogether, officials in the capital have made several attempts to assert control over the rapidly expanding sector. However, all of these disputes have ultimately resulted in the ride-hailing sector emerging as the victor.

The most recent concern arose a few months ago when the city implemented TOT on ride-hailing drivers, which was set to be collected from the current fiscal year onwards. While transport service providers are exempt from paying TOT, those involved in the rental business are obligated to pay this tax as per the law.

Ride-hailing providers previously paid their taxes based on a presumptive income tax assessment. But with the new arrangement, they were required to bring a record of the transportation service they provided and the money they earned in the year.

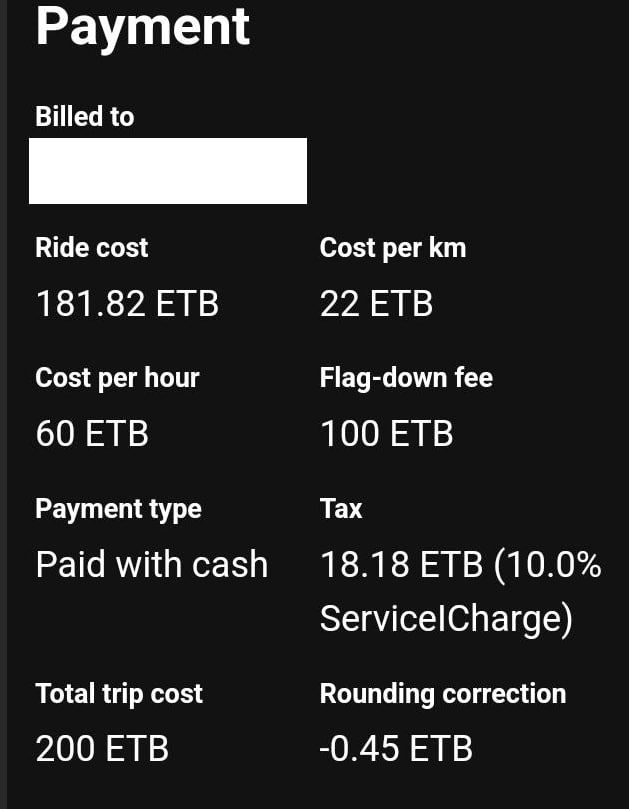

Ride-hailing drivers were expected to bring this exhaustive record after acquiring it from the ride-hailing companies they work with, such as RIDE and Feres. A 10 percent deduction was to be taken from this annualized amount.

In response to this, one of the leading ride-hailing firms, RIDE implemented a 10 percent price increase as these taxes are indirect taxes intended to be paid by the end user.

Muluken Jemberu, a ride-hailing driver, told Shega that the bookkeeping requirement was first implemented last year, while the TOT was put into effect this year.

“Drivers were generally concerned that any additional price increases would make the service more expensive and result in a decrease in demand,” said Muluken.

He further expressed, “In addition, tax officials didn’t allow us to deduct basic expenses done without a receipt, such as the cost of car servicing and tire changes.”

Further exacerbating this situation is the new VAT draft law currently under development. According to the draft, users of ride-hailing services will be obligated to pay a 15 percent VAT on every trip they take. This would replace the existing TOT collection with VAT.

Drafted by experts drawn from the Ministry of Finance and federal tax authorities, the new bill aims to amend the existing VAT proclamation that was legislated in 2002. The current law exempts ride-hailing companies from VAT.

However, both of these taxes have now been eliminated from the ride-hailing sector, bringing much relief to the platforms and their drivers.

The news of the exemption was first announced last week through RIDE Driver Updates, a Telegram channel utilized by Ride to communicate official information to drivers. RIDE has also stated that the recognition of ride-hailing drivers as transport service providers and their exemption from TOT and VAT were a result of its lobbying efforts.

The Ethiopian government has been focused on expanding the tax base, implementing various changes from revisions of excise tax and VAT laws to the crafting of a new property tax. This week, the Addis Ababa City Administration announced that it has successfully collected a total of 107 billion birr, exceeding the initial target set at the beginning of the fiscal year by seven percent.

In the upcoming fiscal year, the administration aims to collect 140 billion birr in taxes, intending to cover the entire budget recently approved by the Addis Ababa City Council.