Progress for 0 ad

Progress for 1 ad

Progress for 2 ad

Progress for 3 ad

Kaleab Girma

Addis Ababa, Ethiopia

Fintech startup Chapa Financial Technologies S.C. has launched its online payment gateway service for local and international payments.

The platform, which went live today, August 17, 2022, opens doors for Ethiopian businesses, enabling them to accept payments from 4.5 billion people worldwide.

“This launch formally establishes our entry into Ethiopia’s financial sector, and we look forward to expanding our fingerprint on the development of the digital ecosystem,” said Nael Hailemariam, CEO and co-founder of Chapa.

Chapa, which has started onboarding merchants, received its Payment Gateway license from the National Bank of Ethiopia (NBE) in May 2022.

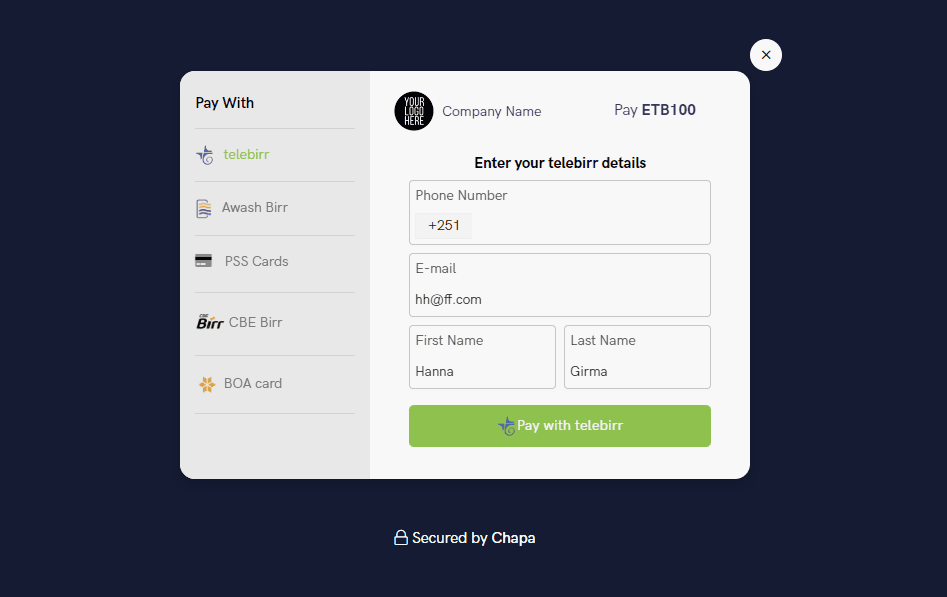

Since then, the startup has been gearing up for launch. Currently, Chapa allows to process payments from eight international payment options and ten local ones.

The international payment options currently processed by Chapa are JCB, Visa, PayPal, Discover, UnionPay MasterCard, Diners Club, and American Express.

Meanwhile, locally, Debit Card/ATM cards of Bank of Abyssinia, Awash International Bank, Addis International Bank, Hibret Bank, Cooperative Bank of Oromia, Berhan Bank, and NiB International Bank are processed by Chapa.

In addition, three mobile money platforms, telebirr, CBE Birr, and Awash Birr, have also been integrated.

To start accepting payment on Chapa, businesses must first go through KYC checks and provide business information such as TIN, business licenses, address, and contact information and get approved.

Merchants will be charged 3.5pc per domestic transaction and 1pc for international transactions, while money is automatically settled into the merchant’s account within 24 hours.

For software developers, Chapa provides easy integration. By adding six lines of code to their website or app for accepting payments, what Chapa describes as “simple as a copy and paste job.”

Chapa has also created a community of developers and programmers who can assist businesses in integrating Chapa’s payment gateway.

“Chapa’s mission is to empower Ethiopian entrepreneurs and businesses to thrive in the global economy,” said Nael.

Inadequate interoperability amongst financial institutions, cash-based e-commerce, lack of functioning digital payment gateways, and limited fintech product offerings have long been the limitations of Ethiopia’s digital economy.

Chapa, aiming to address these gaps, was established in 2020 when the National Bank of Ethiopia opened the fintech space for technology companies. Over a dozen companies applied for a payment gateway license over the past two years, and Chapa was the third firm to receive the green light from NBE, following ArifPay and SunPay.

Cofounded by Nael Hailemariam and Israel Goytom, who have experience working in the technology sector across North America, Europe, and Asia, Chapa has also onboarded various advisors with diverse experiences in companies such as JP Morgan, Google, and LinkedIn.

Chapa, which plans to empower and connect 100,000 entrepreneurs and businesses to the global economy by 2025 also eyes the African market.

Besides offering, merchants who process large volumes a discount on the transaction fee; Chapa provides metrics, data, and analytics to its merchants, helping them have insights into their business operations and make data-driven decisions.

It’s to be recalled that Chapa last month formed a partnership with Mila-Quebec Artificial Intelligence Institute, the world’s largest deep learning institute. This partnership enables Chapa to further research within the AI and machine learning world, allowing financial inclusion for SMEs and businesses.

In addition, Chapa is hoping to lean on its past initiatives to kick start its operations. Last year Chapa developed MyGerd.com, raising USD 300 thousand for the Great Ethiopian Renaissance Dam (GERD), partnering with Ethiopian Electric Power (EEP), Flutterwave, and Zemen Bank.

Then, in November 2021, Chapa developed Eyezon, raising over USD 6 million for internally displaced Ethiopians and conflict-damaged health facilities, partnering with the Ethiopian Diaspora Agency (EDA) and the Commercial Bank of Ethiopia (CBE).

👏

😂

❤️

😲

😠

Kaleab Girma

Kaleab Girma is a journalist and researcher with more than eight years of experience. He serves as Shega’s Media Manager, reporting on businesses, innovation, technology, and startups in Ethiopia.

Your Email Address Will Not Be Published. Required Fields Are Marked *